An individual's net worth in 2024 represents the total value of their assets, minus their liabilities. This figure is a snapshot of an individual's financial standing at a specific point in time and reflects a variety of factors, including investments, property holdings, and personal possessions. Determining this value requires careful consideration of market conditions and valuations at the time of assessment.

Understanding an individual's net worth provides insight into their financial health and capacity. This data is crucial for various purposes, from personal financial planning to business valuations and investment decisions. The public perception of an individual's net worth can impact their reputation and influence. Historical data on net worth can also reveal trends in wealth accumulation, economic conditions, or industry performance.

Further exploration into specific individuals' financial situations, including wealth management strategies, industry sectors, or societal contexts, will require more context. Information on specific individuals will be crucial to answering in-depth questions about this data, such as the trends in wealth and the dynamics of their industries or companies. Further analysis of the specific context will be necessary to understand the meaning and significance in relation to their individual circumstances and industry.

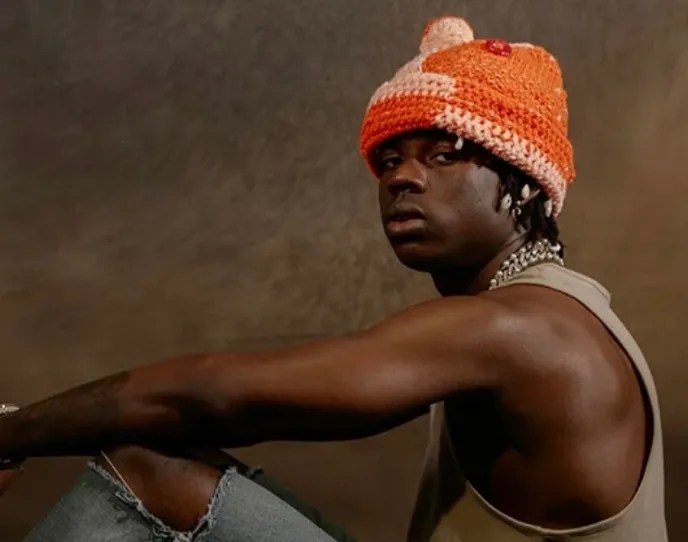

Rema Net Worth 2024

Estimating an individual's financial standing, often represented as net worth, provides valuable insights. This data encompasses various factors crucial for understanding their financial health and economic standing.

- Asset valuation

- Liability assessment

- Market fluctuations

- Investment performance

- Income sources

- Wealth accumulation

The net worth figure reflects the current value of assets less liabilities. Accurate asset valuation depends on market conditions and factors like property appraisals and investment portfolio evaluations. Liability assessment considers outstanding debts and financial obligations. Market fluctuations significantly impact asset values, especially investments. Income sources directly contribute to accumulating wealth, while past performance of investments is crucial for projecting future accumulation. Historical records of wealth accumulation provide context and understanding of economic growth or decline. For example, analyzing investment performance can reveal market trends and identify potential risks or rewards, influencing strategies.

1. Asset Valuation

Accurate asset valuation is fundamental to determining net worth. The process of assessing the worth of assets, including property, investments, and other holdings, is crucial for calculating the overall financial standing reflected in net worth, particularly in a specific year like 2024. This process considers various factors impacting the market value of these possessions.

- Market Conditions and Trends

Current market conditions significantly influence asset valuations. Fluctuations in real estate markets, stock prices, and commodity values directly impact the assessed worth of holdings. Understanding these trends is essential for a comprehensive valuation and accurate representation of an individual's overall financial position.

- Appraisal Methods and Expertise

Different asset types require specific appraisal methods. Real estate valuations often involve professional appraisals considering comparable sales, property condition, and location. Investment valuations depend on the specific instruments, like stocks or bonds, and may require expert analysis of financial statements and market trends. Competent valuation professionals are critical to obtaining accurate assessments.

- Time Sensitivity of Valuations

Asset valuations are not static; they change over time due to market movements and economic conditions. A valuation at one point in time does not necessarily reflect the worth at a later date. This time sensitivity is important to consider when assessing net worth for a particular year, acknowledging the dynamics of the market.

- Influence on Financial Decisions

Accurate asset valuations directly affect various financial decisions. They inform investment strategies, lending capacities, and tax implications. Investors rely on valuations to make informed decisions regarding purchases, sales, and overall portfolio management. A reliable valuation process underpins sound financial planning.

In summary, accurate asset valuation is indispensable for a precise calculation of net worth. Different approaches and considerations are necessary depending on the asset type. Understanding the role of market conditions, appraisal methods, and time sensitivity in the valuation process is essential for a comprehensive understanding of financial standing. This multifaceted process underpins informed financial decisions and provides a more complete picture of an individual's net worth in 2024.

2. Liability Assessment

Accurate liability assessment is integral to determining net worth. Debt and financial obligations significantly impact the overall financial standing represented by net worth in any given year, including 2024. Understanding these liabilities provides a complete picture of financial health and capacity.

- Types of Liabilities

Liabilities encompass various forms of debt, including loans (mortgages, personal loans, auto loans), credit card balances, outstanding invoices, and other financial obligations. Categorizing and quantifying these debts are essential steps in the assessment process. Variations in these types of liabilities exist, impacting net worth in different ways.

- Impact on Net Worth Calculation

Liabilities directly reduce net worth. The calculation subtracts the total value of liabilities from the total value of assets to arrive at net worth. A high level of debt can significantly reduce or even negate a substantial asset base, lowering the net worth figure. The impact is inversely proportional; higher liabilities diminish net worth.

- Time Value of Debt

The time frame for repayment and interest rates associated with different liabilities influence their impact. A large loan with a long repayment period and high interest rate can have a more substantial effect on net worth compared to smaller, shorter-term debts. The timing and structure of liabilities are important factors.

- Influence on Financial Decisions

Liability assessment informs financial decisions, including budgeting, investment strategies, and borrowing decisions. Understanding the extent and nature of liabilities allows for proactive measures to manage debt and improve overall financial well-being. The potential for increased interest rates can dramatically impact a person's ability to manage their liabilities, influencing their financial future.

In conclusion, careful assessment of liabilities is critical for accurate net worth calculations. Different types of liabilities have varying impacts on net worth. The time value of debt and interest rates contribute to the overall effect on the calculation. Furthermore, a thorough understanding of liabilities is instrumental in making well-informed financial decisions, crucial for maintaining a positive and stable financial situation.

3. Market Fluctuations

Market fluctuations significantly influence an individual's net worth, particularly in a specific year like 2024. Investment portfolios, real estate holdings, and other assets are directly tied to market conditions. Positive trends in the market generally enhance net worth, while adverse trends can diminish it. The correlation between market fluctuations and net worth is a critical factor in understanding personal and collective financial well-being.

Consider the impact of stock market volatility. A substantial decline in stock prices can drastically reduce the value of investments, thus impacting net worth. Conversely, periods of market growth can lead to substantial increases in the value of investments, boosting net worth. Similarly, real estate markets fluctuate based on various factors, including interest rates and local economic conditions. A downturn in the real estate market may lead to decreased property values, reducing an individual's net worth. Conversely, a thriving real estate market can increase property values, contributing positively to an individual's net worth. These fluctuations are not isolated occurrences but are connected to broader economic trends and market forces that directly affect individual financial positions.

Understanding the connection between market fluctuations and net worth is essential for sound financial planning. Individuals can adjust investment strategies based on market forecasts, mitigating potential losses and maximizing gains. Diversification strategies, for example, can lessen the impact of market downturns on net worth. This understanding allows for more informed decisions regarding asset allocation and risk management. By acknowledging the dynamic relationship between market fluctuations and individual financial standing, individuals can better navigate economic uncertainties and safeguard their financial future.

4. Investment performance

Investment performance directly influences net worth in 2024. A portfolio's return on investment (ROI) significantly impacts the overall financial standing of an individual. Positive returns add to the value of assets, thus increasing net worth. Conversely, poor investment returns diminish asset values and subsequently lower net worth.

The relationship between investment performance and net worth is causal. Successful investments yield higher returns, translating into a larger asset base and a higher net worth. Conversely, underperforming investments lead to decreased asset values, resulting in a lower net worth. For example, a portfolio heavily invested in technology stocks during a period of rapid growth would likely experience substantial gains, increasing the overall net worth. Conversely, a portfolio heavily reliant on declining industries might suffer losses, diminishing the overall net worth. Historical data demonstrates that consistent, strong investment performance over time consistently correlates with the accumulation of wealth.

Understanding the impact of investment performance on net worth is crucial for strategic financial planning. Investment decisions significantly affect the trajectory of an individual's financial standing. Effective investment strategies and portfolio diversification help mitigate risk and generate returns that can bolster net worth. Thorough analysis of market trends, economic indicators, and risk tolerance is essential for constructing a portfolio that aligns with individual financial objectives. This knowledge equips individuals to adapt to changing market conditions and make informed decisions that optimize their financial standing and overall net worth.

5. Income Sources

Income sources are a critical component of an individual's net worth in 2024. The amount and stability of income directly influence the accumulation and growth of assets. Higher and more consistent income streams allow for greater savings, investment opportunities, and debt repayment, leading to a higher net worth. Conversely, limited or fluctuating income restricts savings and investment capacity, potentially hindering net worth growth or even causing decline. The correlation is fundamental: income fuels the engine of wealth accumulation.

Consider a scenario where an individual experiences a significant increase in income due to a promotion or a new job with a higher salary. This influx of funds enables greater savings, allowing for investments in stocks, bonds, or real estate. Over time, the accumulated returns from these investments contribute to a growing net worth. In contrast, a sudden reduction in income, perhaps due to job loss or economic downturn, immediately impacts savings and investment capacity. Reduced disposable income may necessitate prioritizing debt repayment over savings or investment, negatively affecting net worth. The case study of a business owner who expands their client base, increasing revenue and profit, showcases a direct link between substantial income and increased net worth. Similar situations occur in numerous professions where income directly impacts savings and investment capabilities.

The significance of income sources in determining net worth in 2024 cannot be overstated. Understanding the relationship allows for proactive financial planning. Individuals can strategize to maximize income, diversify income streams, and mitigate risks associated with income fluctuations. This understanding is valuable for individuals aiming to achieve financial security and long-term prosperity. By recognizing the crucial role of income sources, financial planning becomes more effective in pursuing financial goals and potentially increasing one's net worth in the years to come.

6. Wealth Accumulation

Wealth accumulation serves as a cornerstone of an individual's financial standing, directly impacting their net worth in a given year. The process of accumulating wealth involves increasing the value of assets, often through savings, investments, and sound financial practices. In 2024, the level of wealth accumulated demonstrates financial health and capacity, particularly when considered within the context of overall economic trends and market conditions.

Factors contributing to wealth accumulation directly influence net worth. Consistent income, coupled with strategic investment decisions, generally lead to increased wealth and a higher net worth. Conversely, substantial debt or losses in investments can hinder wealth accumulation and potentially reduce net worth. Real-life examples illustrate this connection. Entrepreneurs who effectively scale their businesses often experience substantial increases in wealth, reflected in a corresponding rise in net worth. Conversely, individuals who take on excessive debt without sufficient income generation might see their net worth diminish over time. Furthermore, fluctuations in the market value of assets held by an individual also directly affect the calculation of net worth, illustrating the dynamic interplay between wealth accumulation and market forces.

Understanding the relationship between wealth accumulation and net worth is essential for individuals seeking financial security. Effective financial planning often hinges on strategies designed to optimize wealth accumulation. This includes prudent saving habits, sound investment practices, and diligent debt management. By recognizing the key role of wealth accumulation in determining net worth, individuals can develop realistic financial plans aligned with their long-term goals. Challenges like market volatility, economic downturns, or unforeseen expenses underscore the importance of robust financial strategies for maintaining and building wealth, ultimately impacting net worth. In conclusion, wealth accumulation is a pivotal element in assessing an individual's financial standing, significantly impacting their net worth in 2024 and beyond.

Frequently Asked Questions

This section addresses common inquiries regarding an individual's net worth in 2024. Understanding these nuances provides a clearer perspective on financial standing and related factors.

Question 1: What constitutes an individual's net worth?

Net worth represents the total value of assets minus liabilities. Assets encompass property holdings, investments, and other possessions with monetary value. Liabilities include debts and outstanding financial obligations. A precise calculation requires accurate valuation of assets and assessment of liabilities.

Question 2: How are assets valued for net worth calculations?

Asset valuation depends on the asset type. Real estate often relies on professional appraisals considering comparable sales, location, and condition. Investment valuations hinge on market conditions and the specific investment type, utilizing financial statements and expert analysis.

Question 3: What role do market fluctuations play in determining net worth?

Market fluctuations significantly impact asset valuations, directly affecting net worth. Changes in stock prices, real estate values, and other market conditions influence the assessed worth of assets. Understanding these fluctuations is crucial for comprehending the dynamic nature of net worth.

Question 4: How do income sources influence an individual's net worth?

Consistent and substantial income streams facilitate asset accumulation and debt repayment. Increased income allows for greater savings and investment, potentially leading to higher net worth. Conversely, reduced income can restrict investment capacity and potentially diminish net worth.

Question 5: What is the significance of investment performance in relation to net worth?

Investment returns directly impact asset values and consequently net worth. Successful investments contribute to wealth accumulation, leading to higher net worth. Poor investment outcomes can reduce the value of assets, resulting in a lower net worth. Understanding market conditions and investing strategies is crucial.

Question 6: How do liabilities affect the calculation of net worth?

Liabilities, such as outstanding debts and financial obligations, directly reduce net worth. The calculation subtracts the total value of liabilities from the total value of assets to determine net worth. Higher levels of debt can significantly lower net worth.

In summary, assessing an individual's net worth involves a comprehensive evaluation of assets, liabilities, and external factors like market conditions and investment performance. Understanding these interconnected elements provides a more nuanced understanding of financial standing.

The following sections will delve into specific aspects of individual financial situations and considerations for wealth management strategies.

Tips for Understanding and Maximizing Net Worth in 2024

Accurate assessment and strategic management of financial resources are crucial for achieving desired financial outcomes. The following tips provide guidance on navigating the complexities of financial planning and maximizing net worth potential.

Tip 1: Prudent Asset Allocation

Diversifying investments across various asset classes, including stocks, bonds, real estate, and alternative investments, mitigates risk and potentially enhances long-term returns. A balanced portfolio can help manage fluctuations in market conditions, contributing to a more stable and resilient net worth. Diversification reduces the impact of poor performance in any single asset class.

Tip 2: Effective Debt Management

Minimizing and strategically managing debt is crucial for maximizing net worth. Prioritize high-interest debt repayment and explore debt consolidation options to lower overall interest costs. Debt reduction frees up resources for savings and investments, positively impacting net worth.

Tip 3: Consistent Savings and Investing Habits

Regular savings and investments, regardless of amount, are essential for consistent wealth building. Establish automatic transfers into savings and investment accounts to cultivate discipline and ensure consistent contributions. Compounding returns, even with modest amounts, significantly contribute to long-term wealth growth.

Tip 4: Thorough Financial Planning

Developing a comprehensive financial plan considers individual goals and risk tolerance. This plan guides investment decisions and ensures actions align with long-term financial objectives. Regular review and adjustments to the plan are essential for adapting to evolving circumstances and maintaining a strategic approach.

Tip 5: Regular Monitoring and Review

Tracking financial progress regularly, monitoring investment performance, and reviewing the financial plan is crucial. Adjusting the plan as market conditions and individual circumstances change ensures the plan remains relevant and aligned with goals. This dynamic approach adapts to evolving economic landscapes.

Tip 6: Seeking Professional Advice (When Appropriate)

Consult with qualified financial advisors for personalized guidance and strategic support in complex financial situations. Experts offer insights and guidance tailored to individual circumstances and risk tolerance, facilitating informed decisions for optimized wealth building.

By implementing these tips, individuals can make informed financial choices, potentially increasing their net worth in 2024 and beyond. Consistent effort, coupled with a well-defined plan, will yield positive results in the long term.

The subsequent sections will elaborate on specific strategies for various investment types and wealth management approaches.

Conclusion

This analysis of Rema's net worth in 2024 explores the multifaceted factors influencing financial standing. Accurate asset valuation, encompassing market conditions and appraisal methods, is critical. Liability assessment, including debt levels and repayment schedules, directly impacts the overall financial picture. Market fluctuations significantly influence asset values, impacting net worth positively or negatively. Investment performance, income sources, and the process of wealth accumulation all play crucial roles in determining and shaping an individual's financial health. Understanding these interconnected elements provides a comprehensive perspective on Rema's financial position within the context of 2024.

The dynamic interplay of these factors underscores the importance of diligent financial planning. Individuals seeking to maximize their financial standing benefit from a well-defined plan encompassing consistent savings, effective debt management, strategic investments, and a thorough understanding of market trends. Maintaining a comprehensive financial overview allows for informed decisions, facilitating long-term financial security and prosperity. Continued monitoring and adjustment of strategies based on evolving market conditions and personal circumstances are essential for sustainable wealth management. Ultimately, the assessment of Rema's net worth in 2024 serves as a benchmark for evaluating financial health and informs future strategies for enhanced financial well-being.

Article Recommendations

- Janice Combs An Iconic Influence In Entertainment And Fashion

- Mike Tirico Ethnicity Career And Legacy

- Is Kimberly Guilfoyle Gavin Newsoms Exwife Truth Revealed